Payment Processors: The Hidden Margin Crisis No One’s Talking About

The payment processing industry faces a hidden crisis. While Independent Sales Organization (ISOs) portfolios appear stable, their profitability has quietly eroded, and most haven’t noticed why.

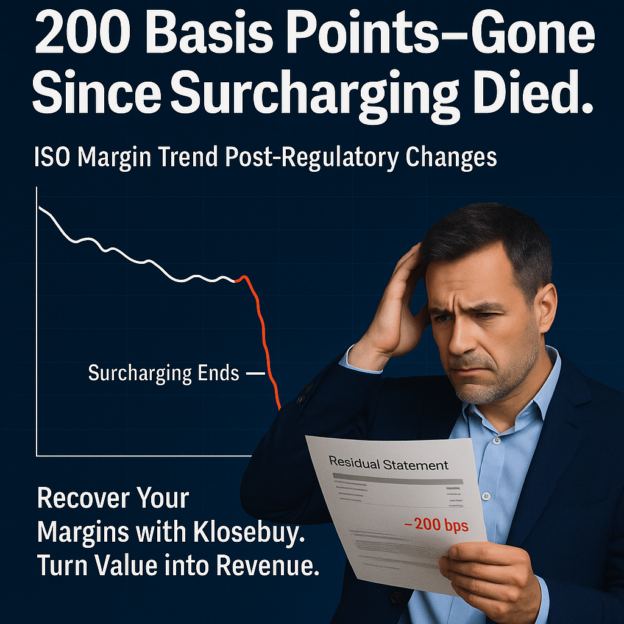

Surcharge Incremental Revenue Has Diminished

For years, surcharging gave ISOs invisible pricing power. With merchants able to pass on processing costs to consumers, they accepted higher processing rates with 150–200 basis points built in, with little resistance. Merchants accepted these rates because they weren’t truly absorbing them. That buffer is disappearing.

As surcharging faces legal scrutiny, brand backlash, and consumer pushback, merchants are absorbing costs they once deflected. Result? They’re shopping aggressively for better rates, and ISOs are trapped between margin erosion and portfolio attrition.

Why Rate Competition Fails

Traditional responses only accelerate the race to the bottom:

- Rate reductions permanently destroy profitability

- Fee bundling provides temporary relief but doesn’t address the core issue

- Merchants now view processing as a commodity expense to minimize

What’s needed isn’t a pricing strategy, it’s a fundamental shift in how merchants perceive value.

Klosebuy – The Strategic Solution

Klosebuy transforms this dynamic by making payment processing a growth driver, not just an operational cost. Merchants receive digital engagement tools that increase customer frequency and transaction volume. When processing directly drives revenue growth, rate negotiations become irrelevant.

Proven Results:

- 40%+ merchant adoption across portfolios

- 10%+ transaction volume increases within 90 days

- 15–20% recovery of lost margin capacity

Customized Portfolio Analysis

Each day payment processors delay strategic repositioning, competitors gain ground. The merchants shopping for rates today set tomorrow’s pricing expectations for your entire portfolio.

Let us help with our proprietary portfolio model, developed in collaboration with former payment executives, provides customized recovery analysis tailored to your specific merchant mix. This includes breakeven timing, revenue outcomes, and profit optimization, all designed to meet the unique needs of your portfolio composition.

The choice is yours: accept diminishing returns or rebuild competitive positioning around demonstrated merchant value.

Let us show you what strategic margin recovery looks like. Contact us sales@klosebuy.com

Disclaimer: Individual results may vary. Metrics are based on internal analysis. Performance outcomes depend on portfolio size, merchant mix, and implementation strategy.